The Rise of NVIDIA: A Brief History

NVIDIA Corporation, founded in 1993, has undergone a remarkable transformation over the past decade, evolving from a graphics card manufacturer to a pivotal player in artificial intelligence (AI), gaming, and data center solutions. Ten years ago, the company was already known for its groundbreaking graphics processing units (GPUs), which were predominantly utilized in gaming applications. However, it is the successive innovations and market expansions that have significantly contributed to its spectacular growth since then.

One of the key milestones in NVIDIA’s history is the launch of the Pascal architecture in 2016. This architecture not only enhanced performance in gaming and professional graphics but also laid the groundwork for advancements in AI and deep learning. The introduction of the Tesla GPUs further propelled NVIDIA into data center applications, showcasing the versatility of its technology. As machine learning gained traction, so too did the demand for high-performance computing hardware, resulting in a substantial uptick in NVIDIA’s stock value.

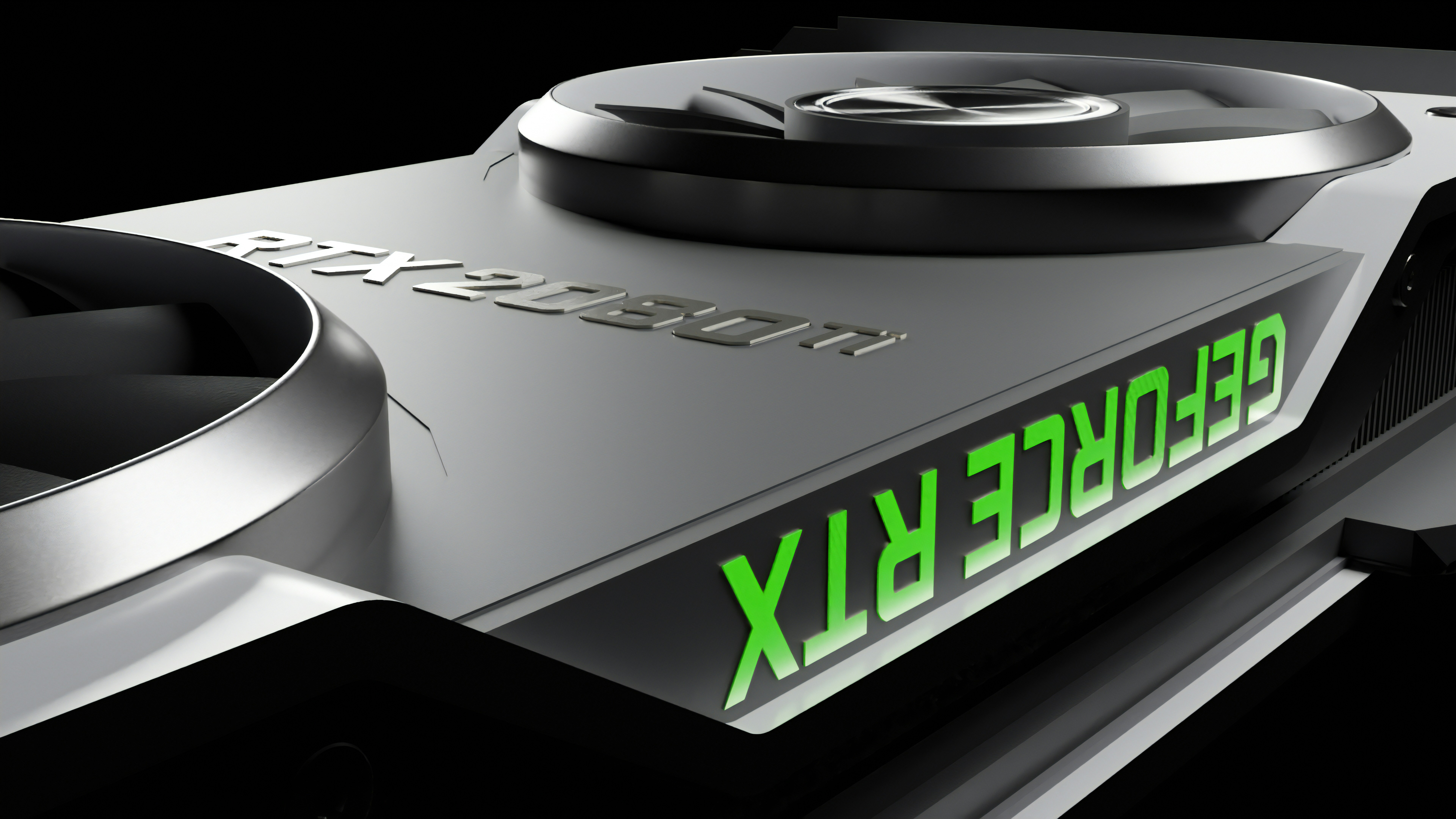

The company has also skillfully capitalized on the soaring popularity of esports and gaming. While new gaming consoles debuted and the gaming industry thrived, NVIDIA’s cutting-edge technology became synonymous with high-quality visuals, ultimately bolstering its reputation among consumers and investors alike. The release of its GeForce RTX line in 2018, featuring real-time ray tracing capabilities, solidified NVIDIA’s position in the competitive gaming space, reinforcing its growth potential.

Furthermore, as AI applications proliferated across diverse sectors, NVIDIA emerged as a cornerstone technology supplier, attracting the attention of investors seeking long-term growth opportunities. The company’s strategic partnerships and acquisitions, such as the intent to acquire Arm Holdings, further emphasized its commitment to expanding its footprint in the tech landscape.

Overall, NVIDIA’s remarkable journey over the past decade illustrates how innovative technologies, combined with strategic market insights, have fostered investor confidence and led to substantial returns for those who believed in the company’s potential.

Calculating the Investment: From $10,000 to Millions

To understand the growth trajectory of an initial investment of $10,000 in NVIDIA stock over the past decade, it is vital to analyze the company’s stock performance, including stock splits, historical price data, and any dividends paid. Looking back ten years, in 2013, the stock price of NVIDIA was approximately $15. This means that an initial investment of $10,000 would have allowed the purchase of around 666 shares of NVIDIA stock.

Over the years, NVIDIA has experienced significant growth driven largely by its advancements in graphics processing technology and the increasing demand for its products in gaming, artificial intelligence, and data centers. As of October 2023, NVIDIA’s stock was priced at around $480. If we calculate the value of the initial 666 shares at this current price, your investment would appreciate dramatically as follows:

666 shares multiplied by $480 per share equals approximately $319,680. This growth illustrates a substantial return on investment, transforming the original $10,000 into nearly $320,000. Additionally, it is essential to consider the company’s stock split that took place, which further increased the number of shares held without additional investment.

Moreover, while NVIDIA has not consistently offered dividends over this period—favoring reinvestment into growth—any dividends provided would factor into the total returns. The power of compounding plays a crucial role, wherein reinvested capital can lead to exponential growth over time. The combination of stock price appreciation, potential dividends, and the favorable effects of compounding illustrates the remarkable financial journey that an investor would have experienced by holding NVIDIA stock throughout the decade.

Market Trends and Factors Driving Growth

Over the past decade, NVIDIA has emerged as a dominant player in the technology sector, capitalizing on significant market trends that have propelled its growth. One of the primary drivers of their success has been the exponential demand for graphics processing units (GPUs) across various industries. The gaming sector, in particular, has fueled this demand as consumers seek enhanced gaming experiences through high-performance graphics. This shift has not only benefited NVIDIA but has also established it as a benchmark for gaming hardware innovation.

In addition to gaming, the surge in cloud computing and data centers has further amplified the need for NVIDIA’s products. As enterprises increasingly adopt cloud-based solutions, the necessity for powerful GPUs to handle extensive data processing tasks has skyrocketed. Data centers leverage GPU technology to improve efficiency, reduce costs, and enable advanced analytics, making NVIDIA an integral partner in these evolving infrastructures.

Furthermore, the rise of cryptocurrency mining represents another key factor contributing to NVIDIA’s impressive performance. As the popularity of cryptocurrencies has soared, so too has the demand for specialized hardware capable of processing cryptographic calculations. NVIDIA’s GPUs are highly coveted within the cryptocurrency mining community, leading to a substantial increase in sales during market booms.

An additional dimension to NVIDIA’s growth trajectory has been its strategic partnerships and collaborations. Partnering with leading tech companies and providing cutting-edge technology solutions have strengthened its market position. By fostering relationships with sectors like automotive technology for self-driving cars and AI development, NVIDIA has diversified its revenue streams, ensuring its relevance across multiple markets.

Overall, the combination of robust demand in gaming, data centers, cryptocurrency mining, and strategic alliances has profoundly influenced NVIDIA’s growth story over the last ten years, resulting in substantial returns for long-term investors.

Lessons Learned and Future Outlook

NVIDIA’s remarkable growth over the past decade serves as an essential case study for potential investors. Analyzing their journey provides valuable insights into the importance of adopting a long-term investment strategy. Investors who purchased NVIDIA stock ten years ago and held onto it, despite market volatility, have reaped significant rewards. This reinforces the concept that patience and commitment to a well-researched investment can yield favorable returns over time.

In addition to a long-term perspective, conducting comprehensive market research is crucial. NVIDIA has excelled by continuously innovating and adapting to emerging technologies, particularly in fields such as artificial intelligence and gaming. Keeping abreast of industry trends and assessing a company’s potential can significantly influence investment decisions. Moreover, understanding a company’s competitive advantages, like NVIDIA’s dominance in graphics processing units (GPUs), is paramount for potential investors aiming to make informed choices.

However, while long-term strategies and thorough research are vital, it is equally imperative to exercise caution against speculative investing. The allure of rapid gains often leads individuals to make impulsive decisions, which can result in substantial losses. As observed with many tech stocks, market fluctuations can be unpredictable, and investments should be based on sound financial principles rather than market hype.

Looking forward, NVIDIA appears well-positioned for future growth, driven by its innovations in AI, cloud computing, and other emerging sectors. As industries increasingly integrate AI technologies into their operations, NVIDIA’s significance is expected to rise. Therefore, potential investors should remain attentive to market developments and consider how technological advancements will shape NVIDIA’s trajectory. Ultimately, reflecting on these lessons will allow individuals to make more informed choices in their investment endeavors.