What is a Stock Split?

A stock split is a corporate action that increases the number of a company’s outstanding shares while simultaneously reducing the share price, thereby keeping the overall market capitalization unchanged. This financial strategy is commonly employed by companies to make their stock more affordable and attractive to a broader range of investors. For instance, in a 2-for-1 stock split, each shareholder receives an additional share for every share they own, effectively halving the stock price. This adjustment ensures that the total value of the investment remains constant—they hold the same proportion of ownership in the company.

Stock splits serve several purposes in financial markets. Primarily, they aim to boost liquidity by lowering the share price, making shares accessible to retail investors and potentially increasing trading volume. When a company’s share price rises significantly, it may become perceived as expensive, which can deter potential buyers. Thus, a stock split can make the stock more enticing, aligning with investor psychology.

There are various types of stock splits, including forward splits and reverse splits. A forward split, as discussed, involves dividing existing shares into a larger number, while a reverse split consolidates shares, effectively increasing the share price. Companies may pursue reverse splits when facing potential delisting from stock exchanges due to low share prices. The impact of a stock split on investors can differ; while it does not alter the intrinsic value of their investment, it can signal management’s confidence in the company’s future growth. This strategic decision often plays a role in a company’s overall market perception.

Overview of AVGO’s Stock Performance

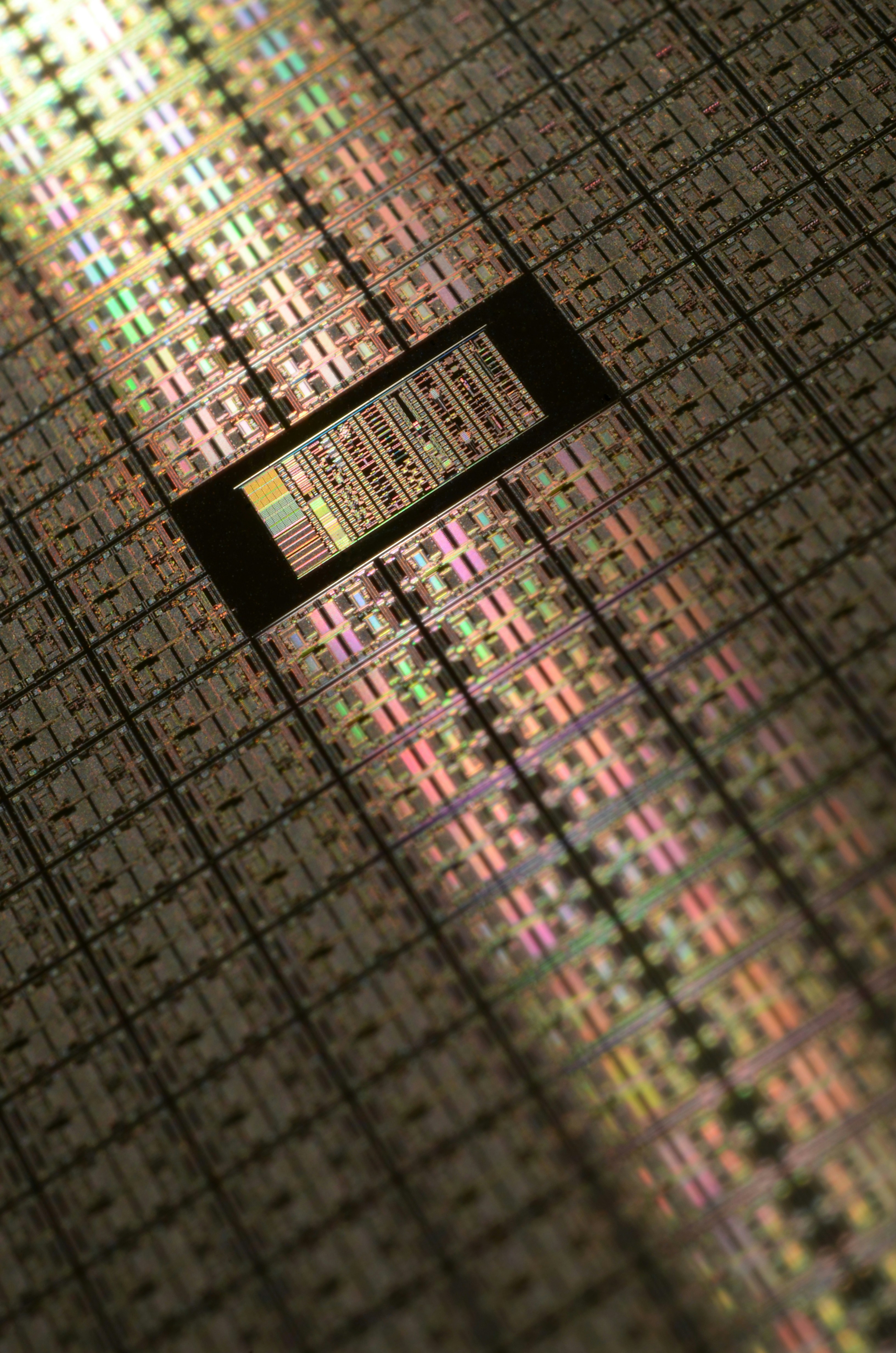

Broadcom Inc. (NASDAQ: AVGO) has consistently demonstrated impressive stock performance leading up to its recent announcement regarding a stock split. Over the past several quarters, the semiconductor company has shown resilience amidst fluctuating market conditions, reflecting both a robust demand for its technology and a competitive positioning within the industry. Prior to the stock split announcement, AVGO’s stock price had witnessed a general upward trend, characterized by significant gains through 2022 and 2023. This growth was primarily driven by an increase in sales stemming from essential sectors such as cloud computing, data centers, and 5G technology.

Throughout this period, Broadcom’s valuation parameters have reflected its substantial contributions to the semiconductor space. For instance, the company has continuously reported strong quarterly earnings, often surpassing analysts’ expectations, which galvanized investor confidence and elevated market sentiment surrounding AVGO’s stock. Furthermore, partnerships and contracts with major tech firms significantly contributed to AVGO’s distinct market position and financial performance.

When compared to its key competitors within the semiconductor industry, such as Intel Corporation and Nvidia, AVGO has exhibited notable achievements. Despite the increasing competition, Broadcom’s strategic focus on high-margin products allowed it to sustain a competitive edge. Furthermore, while some peers faced challenges related to supply chain disruptions and component shortages, Broadcom effectively navigated these obstacles, further enhancing its stock performance. This comparative resilience and proactive approach to market dynamics made it possible for the company to explore a stock split, signaling strong future prospects and a commitment to enhancing shareholder value. These factors underscore the rationale behind the split, positioning AVGO for continued growth and investor appeal.

Reasons Behind AVGO’s Decision to Split Its Stock

Broadcom Inc. (AVGO) has announced a stock split primarily driven by strategic considerations aimed at enhancing shareholder value. One prominent reason for this decision is to make the shares more affordable for retail investors. By splitting the stock, the company aims to lower the barrier to entry for individual investors who may have found the previous share price prohibitive. This adjustment can encourage a more extensive retail participation in the market, potentially increasing the overall demand for the stock.

Another significant factor influencing AVGO’s decision is the potential increase in liquidity for its shares. Stock splits often lead to a greater volume of trades, as smaller share prices can attract more buyers and facilitate quicker transactions. Enhanced liquidity can be advantageous for all shareholders, as it allows for more efficient buying and selling of shares without substantial price fluctuations. Consequently, a more liquid stock may lead to improved price stability, benefiting long-term investors.

Additionally, a stock split can play a pivotal role in attracting a broader base of stockholders. Corporations often seek to position themselves favorably within the market, and a more accessible share price can appeal to institutional investors as well as individuals. AVGO’s management has hinted that this decision aligns with their future growth strategies, as they aim to solidify their position within the semiconductor industry amidst increasing competition. They acknowledge that fostering a diverse shareholder base is essential for long-term success, as it can enhance brand loyalty and support sustained growth.

In the corporate communications preceding the stock split, AVGO’s management expressed confidence in their long-term strategies, indicating that the decision to split was carefully considered and aligns with their market positioning objectives. This proactive approach to attracting investors illustrates AVGO’s commitment to enhancing shareholder value while driving growth in a dynamic market.

Implications of the Stock Split for Investors

The recent stock split by AVGO has generated considerable discussion regarding its potential impact on existing and prospective investors. Understanding the implications of this financial maneuver is vital for making informed investment decisions. Primarily, a stock split can influence shareholder value; while it does not alter the fundamental valuation of the company, it often leads to a change in market perception. Shares become more affordable for retail investors, potentially increasing demand and subsequently driving prices upward in the short term. This phenomenon warrants careful observation, particularly for investors practicing short-term strategies.

Another crucial aspect to consider is how the stock split may affect dividend distributions. Companies occasionally adjust their dividend per share following a split, but in most cases, the overall dividend payouts remain consistent in relation to the company’s financial health. Investors should evaluate AVGO’s history and policies on dividend distributions to ascertain whether the stock split will alter their expected dividend income.

Moreover, investors need to adopt a strategic approach when contemplating their investment moves in the wake of the split. Market sentiment can be dramatically influenced by such events. Short-term traders may focus on immediate price movements, while long-term investors should emphasize the company’s growth potential beyond the split. Assessing the timing of entry into AVGO is crucial; market conditions and investor reactions immediately following the split can result in either opportunities or risks.

Ultimately, investors should weigh their long-term goals against potential short-term gains. A careful analysis of both market conditions and AVGO’s business prospects post-split can guide sound investment decisions. Understanding the implications of this stock split can empower investors to navigate their strategies effectively, maximizing their interests in the evolving landscape of AVGO’s stock performance.